The insurance industry now has the opportunity to reimagine the buying experience for customers. Traditionally, customers would purchase their policies from agents and brokers or digital portals. For certain products, carriers can move past this traditional model and offer personalised products for the customer based on their purchase history or current buy journey. Customers can often become overwhelmed by the multitude of choices between insurance products and plans and may often feel confused about finding the right coverage for them.

In many cases customers do not realise that their brand-new purchases are susceptible to risks which can be protected by insurance. Consider a customer who just purchased a laptop. While searching for an extended warranty online, they abandoned the purchase due to its complexity. Later, they accidentally damaged the laptop, and since the manufacturer’s warranty had expired by then, they had to pay for the additional repairs. Had the customer been presented with an extended warranty covering accidental damage at the time of purchase, their risk would have been insured. This highlights a common coverage gap, where insurable risks go uninsured because the process is too difficult or customers lack information.

Embedded insurance presents a simple approach to this by utilizing data and strategic distribution points, allowing carriers to simplify the process of finding relevant coverage for customers by providing the right coverage at the right time and embedding it into their buy journey, making it more accessible and seamless to purchase insurance. This is a shift from insurance being ‘sold’ by agents or brokers to being ‘bought’ by customers.

Damage to electronics is a small aspect of the bigger conversation around closing the insurance protection gap, which refers to the difference between insured and uninsured losses, the protection gaps show how resilient societies and economies are to disasters. In the context of extreme environmental events such as floods or tornados which have a larger impact on society, the natural catastrophe protection gap remains massive, especially in lower income countries, with only about 30 per cent of catastrophe losses insured, emphasizing the need for insurers to find innovative approaches to cover these risks.

Carriers can tap into new channels that would have previously been tough to capture due to customer perceptions of insurance such as Gen-z customers who place emphasis on convenience or even co-creating new products by working with partners.

Since carriers have the ability to segment their audience at a granular level, they can develop microinsurance or bite size products that make protection more relevant and accessible by targeting demographics at channels they are familiar with.

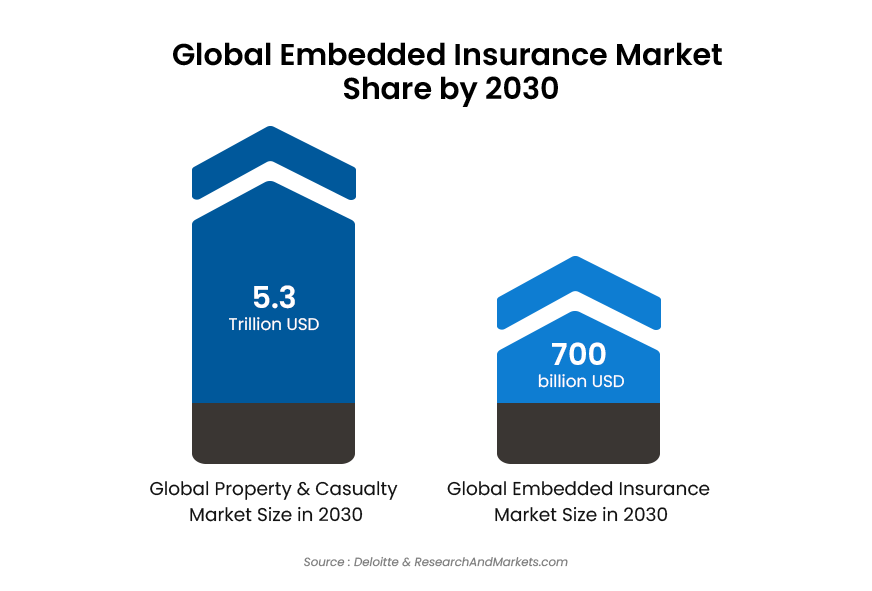

Globally, embedded insurance is expected to generate more than $700 billion in premium income for Property and Casualty lines alone by 2030. For carriers any company with a distribution channel or customer facing operations can become a partner to offer embedded coverage to customers.

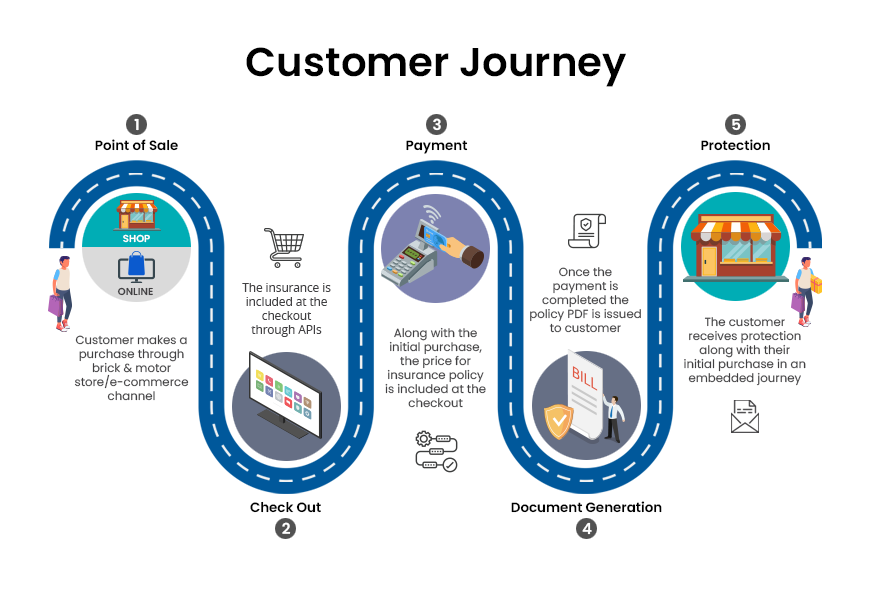

A seamless embedded insurance experience depends on robust technology, particularly APIs (Application Programming Interfaces). APIs allow customer details and policy information to flow between the carrier and partner systems, ensuring a frictionless purchase journey. These APIs can be integrated into the partner’s existing business flows, to distribute embedded products without any disruption to the customer’s journey.

Traditionally, the relationship between operational costs and expanding business has been directly proportional, selling more policies meant working with more agents and brokers to distribute products. But with embedded insurance, cost of acquiring customers drastically reduces, as carriers directly target their audience with pre-underwritten products and share APIs with their partners to distribute the product.

Digital journeys give carriers and partners the flexibility to map the customer journey with a focus on enhancing customer experience and providing coverage as a value-added service to customers. By partnering with embedded insurance platforms, carriers can utilize APIs to develop and distribute embedded products with scale and flexibility.

The opportunity for embedded insurance for carriers is only set to expand with data, partnerships, and technology driving this growth, enabling carriers to develop innovative products that meet customer demands and enhance their buying experience.

For carriers, the success in embedded insurance, lies in developing products that are easily created, constantly updated based on market requirements and personalised based on customer interaction touch points. This not only positions insurers for growth but also helps redefine insurance as a seamless, enjoyable part of the buy journey.